The world is in a volatile era: economic, geopolitical, and environmental changes all affect the global landscape. Inflation has reached multi-decade highs, prompting a tightening of fiscal policy and pressure on domestic budgets, just as financial aid for the COVID-19 pandemic is being reduced.

Many low-income countries are facing deep financial difficulties. At the same time, Russia’s ongoing war in Ukraine and tensions elsewhere raise the potential for significant geopolitical disruption. Although the impact of the pandemic has moderated in most countries, its long-term ripples continue to disrupt economic activity, particularly in China. And extreme heat waves and droughts across Europe and Central and South Asia have provided a taste of a future ravaged by global climate change.

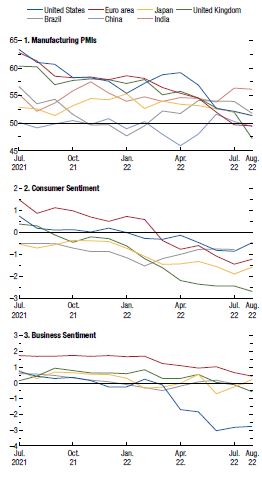

Amidst these volatile conditions, recent data releases confirm that the global economy faces a broad-based slowdown as downside risks – including in the July 2022 World Economic Outlook (WEO) Threats highlighted in the latest threat – materializing despite some conflicting indications. Global real GDP contracted modestly in the second quarter of 2022 (-0.1 percentage point growth at a quarterly annual rate), all driven by negative growth in China, Russia, and the US, as well as a sharp slowdown in Eastern European countries. More directly affected than the war in Ukraine and international sanctions are aimed at pressuring Russia to end hostilities. At the same time, some major economies did not contract — the euro zone’s growth in the second quarter was surprising, thanks to growth in southern European economies dependent on tourism. Future indicators, which gauge new manufacturing orders and sentiment, suggest a slowdown among major economies (Figure 1).

Figure 1. Leading Indicators Show Signs of Slowdown

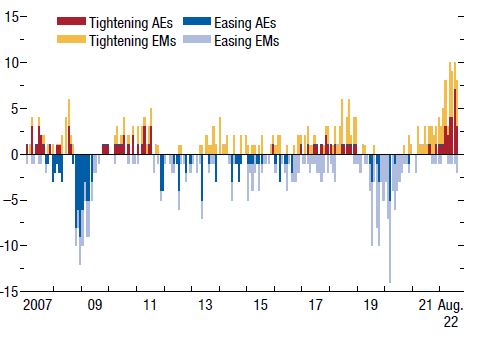

However, in some cases, the conflict signals—some indicators show weakness in output amid a strong labor market. A key factor contributing to the slowdown in the first half of this year is the rapid unwinding of monetary accommodation as many central banks attempt to moderate persistently high inflation (Figure 2).

Figure 2. Change in Monetary Policy Cycle among G20 Economies

High-interest rates and associated increases in borrowing costs, including mortgage rates, are having their intended effect of taking the heat out of domestic demand, with the housing market one of the earliest and most visible signs of a slowdown in economies like the US. Showing symptoms. The tightening of fiscal policy has generally—though not universally—been accompanied by the withdrawal of financial aid, which had previously increased disposable household income.

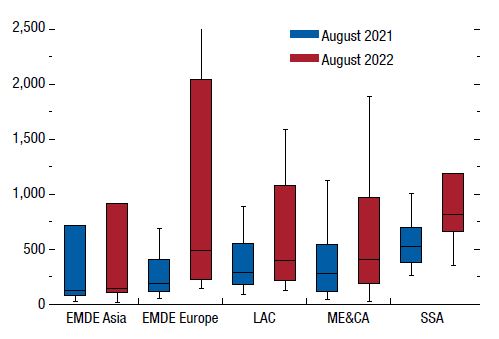

Broadly speaking, nominal policy rates are now above pre-pandemic levels in both advanced and emerging markets and developing economies. With high inflation, real interest rates have generally not yet returned to pre-pandemic levels. With the notable exception of China (October 2022 Global Financial Stability Report), the tightening of financial conditions in most regions is reflected in the appreciation of the real value of the US dollar. It has also widened yield spreads—the difference between countries’ U.S. dollar-or euro-style government bond yields and U.S. or German government bond yields—for debt-stressed low- and middle-income economies (Figure 3).

Figure 3. EMDE Sovereign Spreads

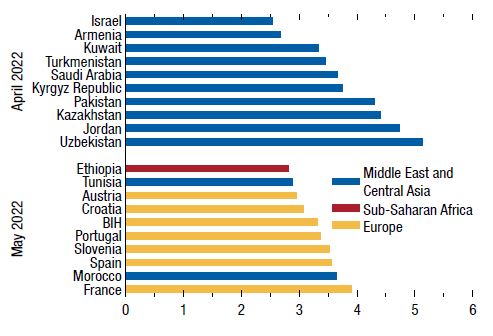

In sub-Saharan Africa, yield spreads for more than two-thirds of sovereign bonds breached the 700 basis point level in August 2022 – significantly higher than a year ago. In Eastern and Central Europe, the effects of the war in Ukraine have increased global risk appetite.

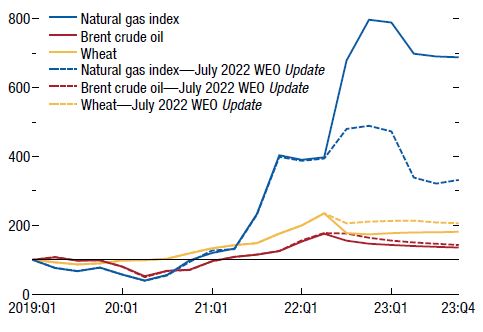

Beyond just fiscal policy, China’s COVID-19 outbreak and movement restrictions as part of the authorities’ zero-COVID strategy and Russia’s invasion of Ukraine have also curbed economic activity. China’s lockdown has imposed major disruptions locally and strained already strained supply chains globally. The war in Ukraine and deep cuts in gas supplies to Europe have added to already-existing pressures on global commodity markets, pushing natural gas prices higher again (Figure 4).

Figure 4. Wholesale Food and Fuel Prices are Expected to Moderate

European economies – including the largest, Germany – are reeling from the effects of low gas supplies. Continued uncertainty over energy supplies has helped slow real economic activity in Europe, particularly in manufacturing, reducing consumer and, to a lesser extent, business confidence (Figure 1). However, a strong recovery in tourism-dependent southern economies helped improve the overall growth forecast in the first half of 2022.

Food prices — a key driver of global inflation so far this year — have provided a rare bit of good news, with futures falling (Figure 4) and the coming months from the Black Sea grain deal. I hope the supply will improve. In general, there are some signs that falling global demand may start to ease commodity prices, helping to moderate inflation. However, recent extreme heat waves and droughts are a stark reminder of the near-term threat posed by climate change and its potential impacts on agricultural productivity (Figure 5).

Figure 5 Mean Land Temperature

Although a modest recovery is forecast for the second half of the year, full-year growth in 2022 is likely to be well below average pre-pandemic performance and strong growth in 2021. The global economy is forecast to grow 3.2 percent in 2022 compared to 2021, with advanced economies growing by 2.4 percent and emerging market and developing economies by 3.7 percent. The global economy will expand even more slowly in 2023, at 2.7 percent, 1.1 percent in advanced economies and 3.7 percent in emerging markets and developing economies.

Three key factors make this economic outlook important: the stance of fiscal policy in response to high inflation, the impact of the war in Ukraine, and the ongoing impact of pandemic-related lockdowns and supply chain disruptions.